Elevator industry: In the era of steady growth, it is time for transformation and breakthrough

Date: 2024-07-15 Categories: Industry News Hits: 279

At present, China is the world's largest elevator producer and consumer. China's elevator production and consumption account for more than 60% of the world's total. It is estimated that the annual elevator production in 2015 will be close to 800,000 units. Calculated at an average price of 200,000 yuan per unit, it is already a market of 100 billion yuan. However, my country's per capita elevator ownership still lags behind developed countries and regions. In the long run, my country's elevator ownership still has a lot of room for improvement.

The stock base and downstream prosperity have pushed the industry into a stable growth stage. The slowdown in the growth rate of new elevator production and sales in my country is due to the fact that the domestic elevator industry has experienced an average annual growth of 20% in the past 10 years, and the elevator production has increased nearly 6 times. It is estimated that the number of elevators will exceed 4.3 million units by the end of 2015. With the expansion of the stock base, the industry has entered a stable growth stage from the original explosive growth stage. On the other hand, as the most important downstream of the elevator industry, the prosperity of the real estate industry is highly correlated with the demand for elevators. As the real estate market declines, the growth rate of the cumulative construction area of houses continues to decline, and the industry demand slows down.

New demand for rail transit, affordable housing, and renovation of old elevators offsets some of the downward pressure. Commercial and residential elevators account for more than half of the total demand for elevators, and about 30-40% of the demand is not closely related to the real estate industry. In contrast to the slowdown in new demand for real estate, elevator sales in several fields such as rail transit, affordable housing and renovation of old elevators have shown a high growth trend. The new demand has formed a certain hedge against the decline in traditional demand. The growth rate of new elevator production and sales can still be maintained at 5-10% in the next 3-5 years.

The after-installation maintenance market is expected to usher in an explosion. In 2015, the 4.3 million elevators in the country will generate at least 20 billion yuan in maintenance income, and as elevators that have been in operation for more than 15 years gradually enter the stage of high maintenance costs, the scale of this after-market is still climbing. At the same time, the form of the elevator maintenance after-market is also changing. For safety and regulatory reasons, more and more elevator owners tend to choose the original elevator factory for professional maintenance. We expect that the proportion of industry maintenance business income in revenue will reach more than 30% in the next five years.

Two major attributes of the industry lay the foundation for future transformation. First, the overall profitability of the elevator industry is stable and the capital is abundant, which provides financial conditions for the external development of enterprises. The future decline in real estate boom and the slowdown in new elevator sales growth will provide an opportunity for corporate transformation, so elevator companies have the motivation to find new growth points. At the same time, the smart manufacturing genes of elevator companies also provide an industrial foundation and breakthrough direction for business transformation. Most domestic elevator production processes are automated, and there is an intuitive understanding of the application prospects of robots. We believe that integrating robots, the Internet of Things and the manufacturing capabilities of elevator companies and entering the field of smart manufacturing is the future development trend of the elevator industry.

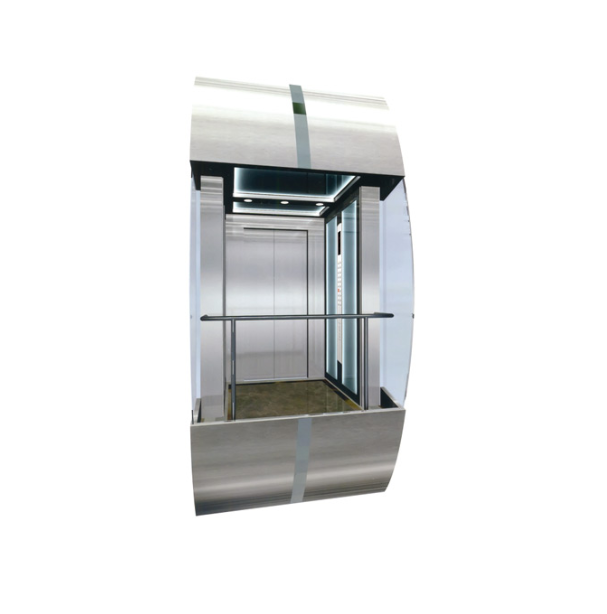

Glass SA-K002

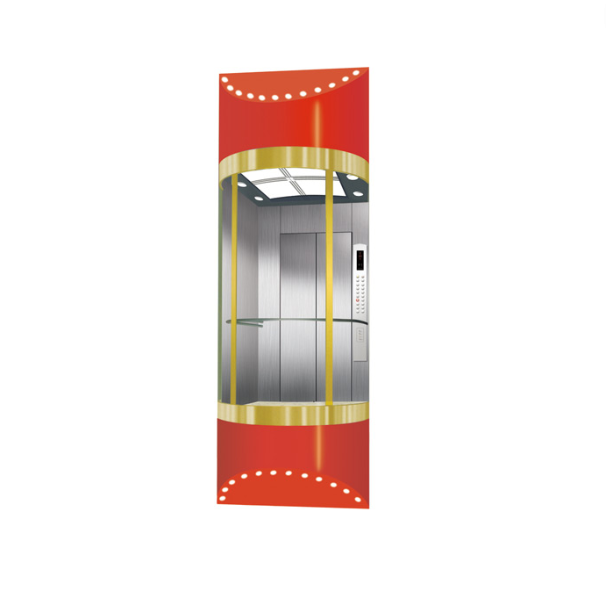

Glass SA-K002  Fashion SA-K007

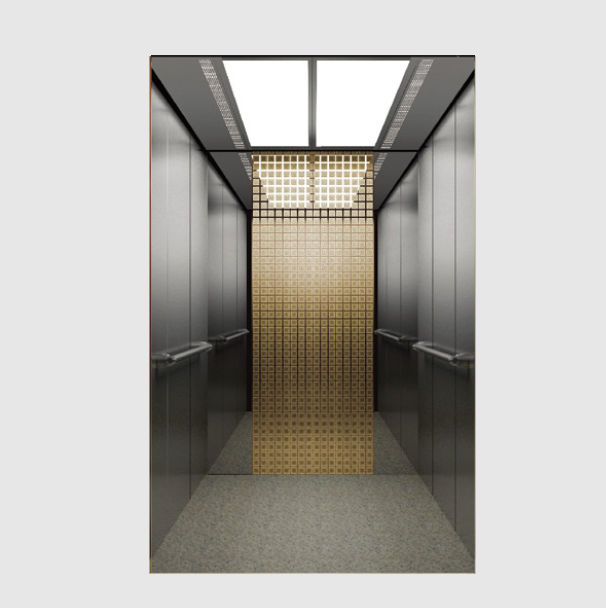

Fashion SA-K007  SA-G005

SA-G005  SA-G004

SA-G004  SA-G003

SA-G003  SA-G002

SA-G002  SA-G001

SA-G001  SA-B002

SA-B002  SA-B001

SA-B001  SA-HJ02

SA-HJ02  SA-HJ01

SA-HJ01  SA-Y005

SA-Y005  SA-Y004

SA-Y004  SA-Y003

SA-Y003  SA-Y001

SA-Y001